Contents

[ad_1]

- Fund supervisor succeeded in ‘flowering in autumn’

Mumbai: Due to the fact final several years, Mutual Resources in particular Equity centered Mutual Fund techniques are turning into more and more common among the retail investors in the country because of to their good returns. Mutual fund homes, many thanks to their staff of fund administrators and investigate analysts, pick the best stocks by executing thorough research from each individual aspect and e-book revenue on time and supply them to their traders, whilst for a retail trader, shares There is a great deal of threat concerned in investing right in the inventory market, due to the fact it is widespread to see large fluctuations in the marketplace. Apart from this, it is not effortless to generate profit by picking out the proper stock in the stock sector. It is a incredibly tough activity, but good mutual fund administrators are equipped to make dollars from the industry with the support of their competencies and knowledge.

By the way, equity mutual fund expenditure is thought of a lot more suited not for the shorter phrase, but for the prolonged time period. Numerous Fairness Mutual Fund strategies have also made substantial prosperity by delivering buyers with extremely superior returns in the lengthy operate as in comparison to other traditional investment avenues. The efficiency of fairness primarily based mutual fund techniques is dependent on the ups and downs in the inventory industry. When there is a bullish phase in the sector, then all the strategies perform nicely and exhibit great returns, but not all carry out nicely in recession. Only a find number of highly competent fund administrators are in a position to carry out properly even in a downturn. In this posting, the information of those techniques have been offered, whose fund managers have been in a position to make revenue even in the economic downturn. The 1st 50 % of 2022 has been in economic downturn and throughout the past 12 months, each the big indices BSE Sensex and NSE Nifty have experienced negligible returns. The return of Sensex has been only .3% and that of Nifty is .6%. Though the BSE Midcap has shed 2.6% and the Smallcap index has misplaced 2%.

Large Cap Resources: Nippon, IDBI, Baroda BNP, SBI MF have created prosperous

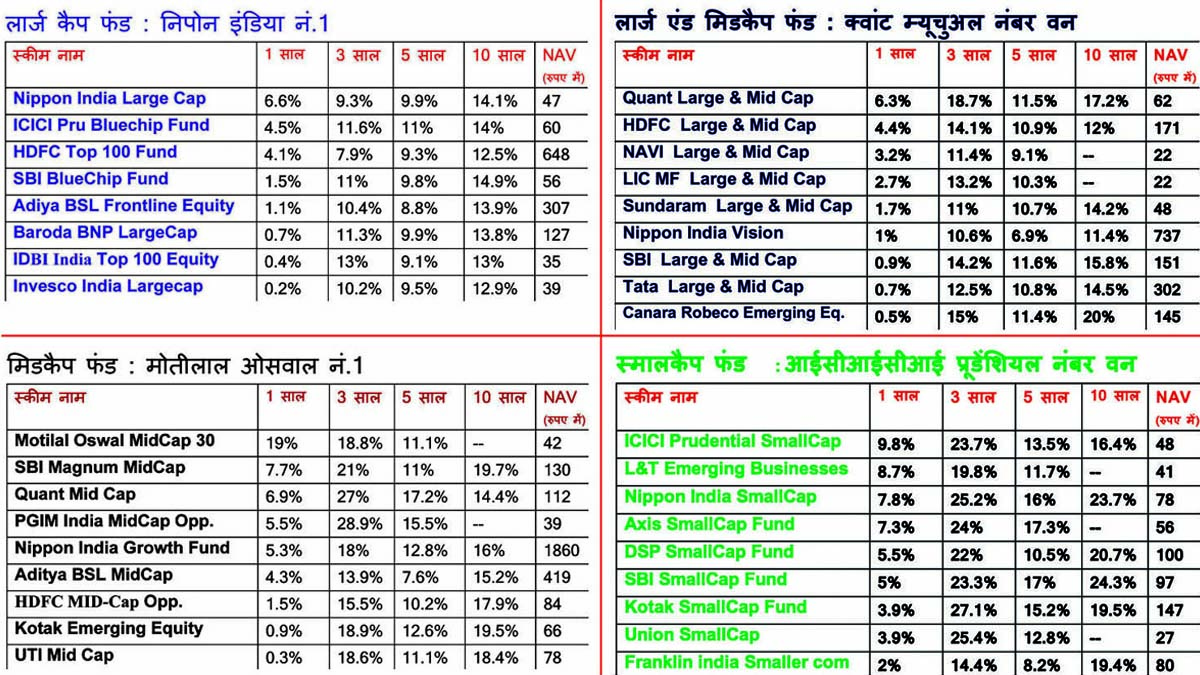

Speaking about Large Cap Resources, which are regarded as the finest for retail investors, out of 30 foremost mutual fund firms, only 8 mutual fund residences have managed to give superior and positive returns than Sensex-Nifty in the past 12 months Huh. Nippon India Massive Cap Fund has specified the maximum income of 6.6%. Its fund professionals are Shailesh Raj Bhan and Ashutosh Bhargava. If we glance at the earnings of the final 3 many years, IDBI India Best 100 Equity Fund has been number 1. It has designed traders wealthy by furnishing the highest Annual Normal Return (CAGR) of 13%. Its fund manager is Alok Ranjan, who is also the Main Investment decision Officer of IDBI Mutual Fund. If an trader would have invested Rs 1 lakh in IDBI India Major 100 Fairness Fund 3 several years ago, then that total has now amplified to far more than Rs 1.50 lakh.

study also

Great Return of 14.90% SBI Bluechip Fund

If we seem at the 5 decades info, Nippon India Massive Cap Fund and Baroda BNP Large Cap have similarly provided yearly return of 9.90%. While SBI Bluechip Fund has been number just one with an extraordinary annual return of 14.90% in 10 several years. Its fund supervisor is Sohini Andani. If an trader would have invested Rs 1 lakh in SBI Bluechip Fund 10 years back again, then that sum has now amplified to additional than Rs 4 lakh. That means 4 times the earnings. Largecap money make investments predominantly in Sensex-Nifty and Nifty-100 companies i.e. bluechip shares.

Massive and Midcap : Quant and Canara Robeco leading

Huge & Midcap Funds are also a preferred classification. Most of these strategies are invested in big cap and mid cap shares. Quant Huge & Midcap Fund has been number one particular in this classification with a return of 6.3% in the final 1 year. Even in 3 yrs, Quant has been the chief with a powerful annualized return of 18.7%. The fund is managed by Sanjeev Sharma, Vasav Sehgal and Ankit Pandey. Whilst SBI Significant & Midcap Fund has been number a person with an annualized return of 11.6% in 5 yrs. Its fund supervisor is Saurabh Pant. Similarly, Canara Robeco Emerging Equities Fund has been No. 1 with a huge yearly return of 20% above a period of 10 many years. 10 a long time ago, if an trader would have invested Rs 1 lakh in Canara Robeco Rising, that amount of money has now elevated to a lot more than Rs 6.27 lakh. That means much more than 6 times income in 10 years. This very best fund is managed by Sridatta Bhandwaldar, who is also the Equity Head of Canara Robeco Mutual Fund.

browse also

Smallcap: ICICI, Kotak, Axis, SBI MF top rated

Resources in this class (Tiny Cap Funds) are mostly invested in shares of rapid-increasing rising smallcap organizations. ICICI Prudential Tiny Cap Fund has been range one with a very good return of 9.8% in the last 12 months. Its fund manager is Harish Bihani. Kotak Modest Cap Fund has been at the major with a robust annualized return of 27.1% around a span of 3 yrs. This fund is managed by Pankaj Tibrewal. While Axis Modest Cap Fund has been the topper with an annualized return of 17.3% over a time period of 5 several years. Its fund administrators are Anupam Tiwari and Hitesh Das. In the same way, SBI Little Cap Fund has established a prosperity of investors by furnishing superb annual return of 24.3% in 10 many years. The greatest fund for creating traders rich is managed by R. Srinivasan does.