Contents

[ad_1]

The sum of cryptocurrency flowing into privateness-enhancing mixer services has reached an all-time high this calendar year as resources from wallets belonging to governing administration-sanctioned groups and prison activity just about doubled, researchers documented on Thursday.

Mixers, also regarded as tumblers, obfuscate cryptocurrency transactions by developing a disconnect concerning the cash a person deposits and the money the person withdraws. To do this, mixers pool money deposited by substantial quantities of end users and randomly combine them. Just about every person can withdraw the whole amount of money deposited, minus a minimize for the mixer, but because the coins arrive from this jumbled pool, it is more durable for blockchain investigators to observe specifically where the revenue went.

Major revenue-laundering danger

Some mixers supply supplemental obfuscation by allowing for end users to withdraw cash in differing amounts sent to distinctive wallet addresses. Other individuals test to conceal the mixing activity altogether by altering the cost on each individual transaction or various the variety of deposit deal with applied.

Mixer use is just not immediately unlawful or unethical. Offered how quick it is to keep track of the move of Bitcoin and some other styles of cryptocurrency, there are legit privateness explanations any individual may possibly want to use 1. But presented the rampant use of cryptocurrency in on-line criminal offense, mixers have progressed as a have to-use instrument for criminals who want to money out with out becoming caught by authorities.

“Mixers current a complicated problem to regulators and users of the cryptocurrency group,” researchers from cryptocurrency evaluation firm Chainalysis wrote in a report that linked the surge to elevated volumes deposited by sanctioned and prison teams. “Practically everyone would admit that financial privacy is useful, and that in a vacuum, you can find no cause products and services like mixers shouldn’t be ready to deliver it. Having said that, the facts exhibits that mixers currently pose a substantial money laundering chance, with 25 percent of cash coming from illicit addresses, and that cybercriminals linked with hostile governments are using advantage.”

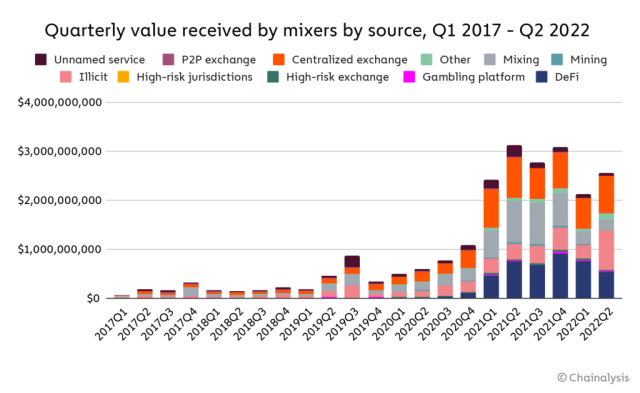

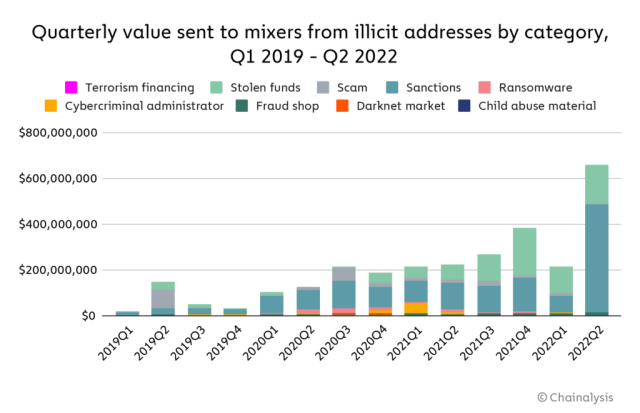

Cryptocurrency gained by these mixers fluctuates considerably from day to working day, so researchers obtain it more helpful to use lengthier-phrase actions. The 30-working day relocating average of cash received by mixers hit $51.8 million in mid-April, an all-time large, Chainalysis noted. The significant-h2o mark represented practically double the incoming volumes at the exact level last calendar year. What’s extra, illicit wallet addresses accounted for 23 p.c of money sent to mixers this year, up from 12 p.c in 2021.

Rogues’ gallery

As the graph under illustrates, the improves occur most notably from increased volumes despatched from addresses related to illicit exercise, these as ransomware attacks, cryptocurrency scams, and stolen cash carried out by teams sanctioned by the US federal government. To a lesser extent, volumes sent from centralized exchanges, DeFi, or decentralized finance protocols, also drove the surge.

A breakdown of volumes connected to illicit resources shows that the spike is driven mostly by sanctioned entities—mainly Russian and North Korean in origin—followed by cryptocurrency thieves and fraudsters pushing cryptocurrency financial commitment scams.

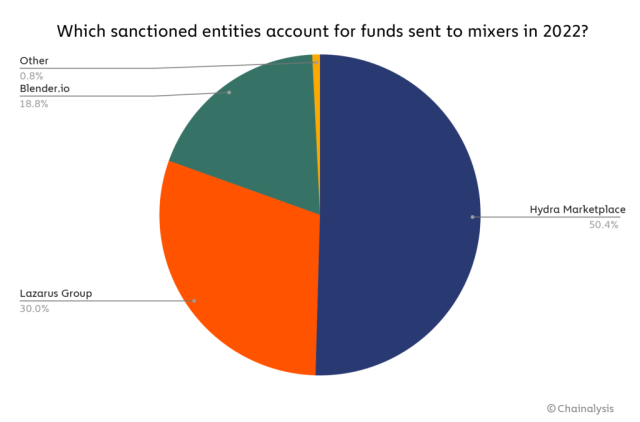

The sanctioned entities are led by Hydra, a Russia-based mostly darkish net industry that serves as a haven for criminals to obtain and market services and products and solutions to one yet another. In April, the US Division of Treasury sanctioned Hydra to stymie the group’s endeavours to liquidate their sick-gotten proceeds. Two North Korean hacking groups—one identified as Lazarus and the other as Blender.io—accounted for most of the remaining volume from sanctioned groups.

Despite their utility, mixers undergo a significant Achilles’ heel: Significant transactions make them ineffective, which means that they perform less successfully when folks use them to deposit huge amounts of cryptocurrency.

“Due to the fact consumers are obtaining a ‘mix’ of funds contributed by many others, if a person person floods the mixer and contributes drastically additional than other individuals, considerably of what they conclude up with will be built up of the funds they initially put in, making it possible to trace the resources back to their first resource,” Thursday’s report stated. “In other terms, mixers operate ideal when they have a significant variety of customers, all of whom are mixing similar quantities of cryptocurrency.”