[ad_1]

Six folks have been indicted in 4 individual cryptocurrency fraud situations involving a lot more than $130 million in losses; together with the single largest NFT plan billed today, federal prosecutors said this 7 days.

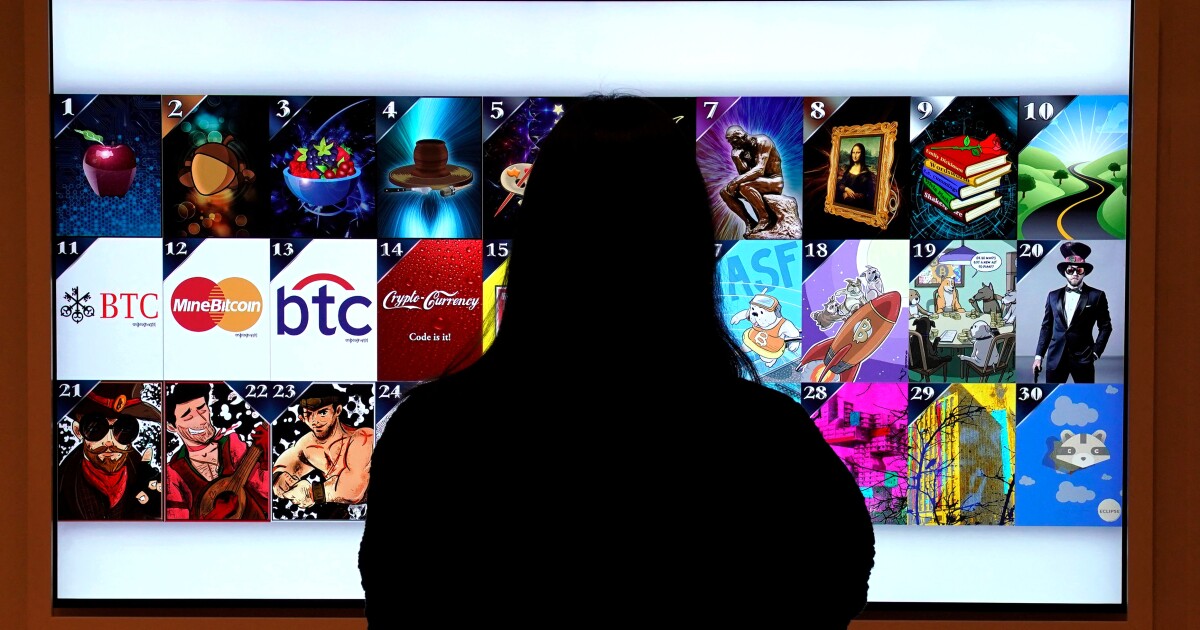

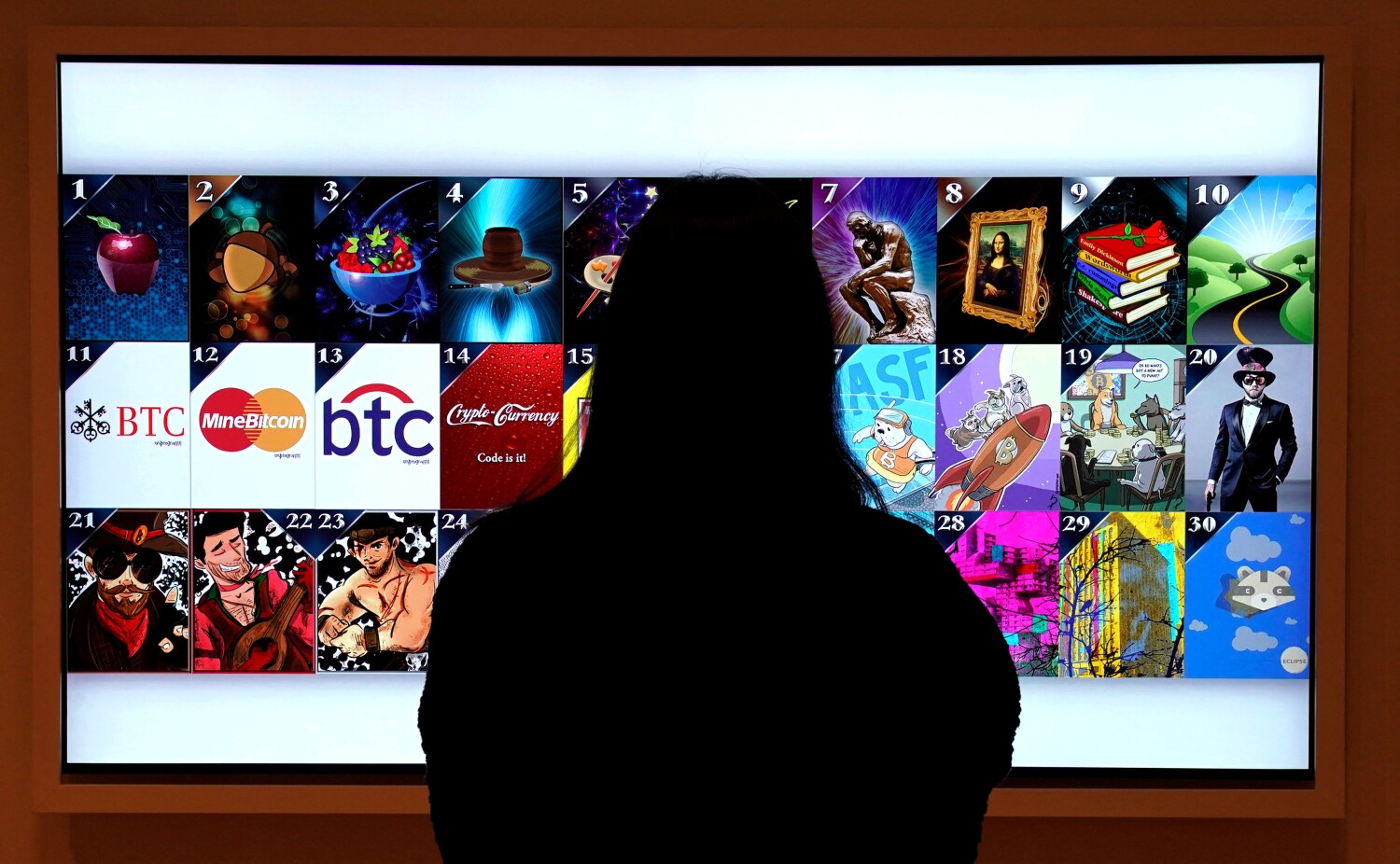

That scheme, prosecutors claimed, was associated with a team identified as the Baller Ape Club that claimed to offer NFTs, or nonfungible tokens, in the form of cartoon images of apes.

A group with an equivalent topic, the Bored Ape Yacht Club, is 1 of the world’s most common NFT distributors, with endorsements from Snoop Dogg, Tom Brady,, and other celebrities. Its nft social media have offered hundreds of hundreds of bucks, while costs have dropped sharply in modern months.

Le Anh Tuan, 26, of Vietnam was charged in California with one particular depend just about every of conspiracy to dedicate wire fraud and conspiracy to dedicate intercontinental funds laundering in relationship with the Baller Ape Club scheme.

Soon immediately after Baller Ape Club’s general public profits commenced, Tuan and unnamed co-conspirators “rug-pulled” traders, deleting the group’s web site and having $2.6 million in investments, in accordance to the U.S. attorney’s business office for the Central District of California.

Tuan and the other individuals laundered the money, prosecutors explained, by moving it via cryptocurrencies and cryptocurrency services.

If convicted, Tuan faces up to 40 a long time in jail.

In a separate case, the founder and former chief executive of Titanium Blockchain Infrastructure Services was charged with one particular depend of securities fraud in relationship with the company’s preliminary coin giving.

New cryptocurrency assignments use ICOs to raise cash, equivalent to an preliminary community offering of a company’s stock.

Federal prosecutors in California mentioned CEO Michael Alan Stollery, 54, of Reseda falsified paperwork despatched to prospective buyers testifying to the project’s purpose and falsely claimed that his organization experienced associations with the U.S. Federal Reserve Board and firms this sort of as Apple, Disney and Pfizer.

The ICO raised about $21 million from investors.

Stollery faces up to 20 years in jail if convicted.

In a third circumstance, a Las Vegas guy was charged in California with 4 counts of wire fraud and a single count each and every of obstruction of justice, conspiracy to commit wire fraud and conspiracy to commit commodities fraud.

David Saffron, 49, employed his cryptocurrency financial commitment system Circle Society to increase about $12 million from investors to a fraudulent crypto fund that purported to trade on the futures and commodity marketplaces, prosecutors claimed.

Saffron allegedly advised investors he utilised a “trading bot” to produce returns up to 600%. He held investor conferences at homes in the Hollywood Hills and traveled with armed stability guards to “create the fake appearance of prosperity and success,” prosecutors said.

“In actuality, Mr. Saffron was running an illegal Ponzi plan to defraud target traders and made use of the funds for his have personal advantage,” reported Ryan L. Korner, specific agent in charge of the IRS’ Los Angeles legal investigation industry office.

Saffron faces up to 115 several years in jail if convicted.

The fourth case introduced by prosecutors this week was charged in the Southern District of Florida.

Emerson Pires and Flavio Goncalves, both of Brazil, and Joshua David Nicholas of Stuart, Fla., ended up charged with one depend each individual of conspiracy to commit securities fraud and conspiracy to dedicate wire fraud in connection with a crypto-Ponzi plan that prosecutors mentioned defrauded about $100 million from buyers. Pires and Goncalves, equally 33, were also charged with conspiracy to dedicate global funds laundering.

Pires and Goncalves, founders of crypto expense platform EmpiresX, labored with “head trader” Nicholas, 28, to endorse the platform using fake ensures of returns for buyers, prosecutors claimed.

“Blockchain analytics demonstrates that Pires and Goncalves then laundered investors’ funds through a foreign-based mostly cryptocurrency exchange and operated a Ponzi plan by spending earlier buyers with income acquired from later on EmpiresX investors,” the U.S. attorney’s office environment mentioned.

If convicted, Nicholas faces up to 25 many years in prison Pires and Goncalves each experience up to 45 several years.