Contents

If you do not have the PAN card, you will have to get it sooner or later. The private limited Company (PLC) should acquire a PAN card after the registration with RoC (Registrar of companies) in India. You can also start the PAN application process by submitting the E-form NIC-29 along with your incorporation documents

Documents that are requires for the PAN card.

Here is the list of required documents the one is obliged to furnish to obtain PAN card you’re your business having online company registration;

For companies incorporated in India;

– Certificate of incorporation or registration copy issued by the RoC (Registrar of companies).

– Company’s registered office’s proof of address.

– DD (demand draft) of the required fee (if payment is made offline).

For companies incorporated abroad;

– Certificate of registration’s copy issued in the country of incorporation. The same requires to be attested by the apostille/Indian embassy/Indian high commission/Consulate/Authorized officials of branches of scheduled Indian banks located in the country of incorporation or;

– Certificate of registration’s copy issued in India, with the sanction by Indian authorities to establish an office in India.

NOTE – if yours is a foreign company, you must apostille all the documents you want to present along with your PAN card. The documents verified by apostille are accepted by all the countries of the world that are a member of the Hague Convention (for abolishing the requirement of legalization for foreign public documents) of 1961. India is also a member of the Convention and one of the founding signatories of the treaty. If your country is also a member, no additional authorization of documents is needed once you get them apostilled.

How one can apply for the PAN card for the private limited Company (PLC).

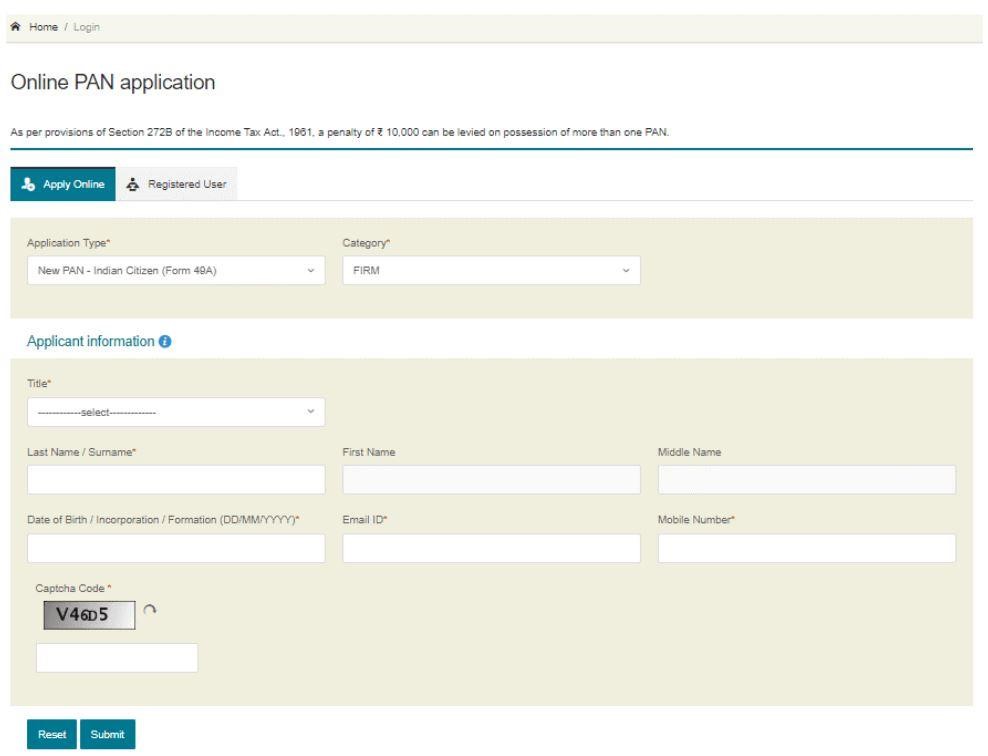

Step one – one should visit the paperless PAN application page given on the NSDL website.

Step two – from the ‘application type’ drop-down menu, one should choose FORM 49A. After selecting that, one should select Company from the Category drop-down menu.

Step three – fill in details of your Company in the given blank spaces. Write M/S in the Title and your company name in the given last name box. Then enter the captcha and click proceed.

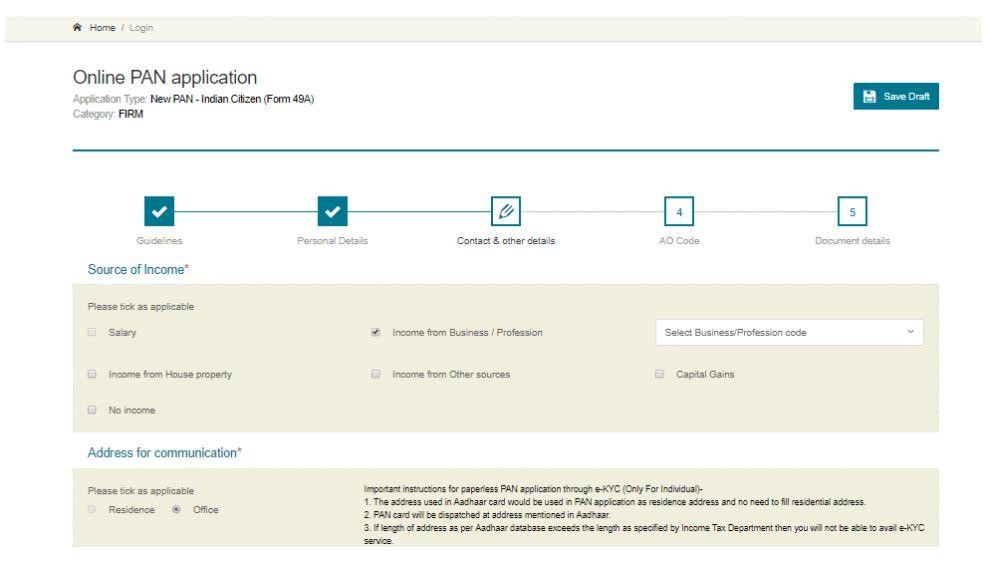

Step four – on the other following page, you are obliged to specify the source of income of your Company. Choose income from profession or business. If you earn from other sources, then tick the apt buttons accordingly. Likewise, fill in your office address in the given blank space. It would be your official communication address on the PAN database.

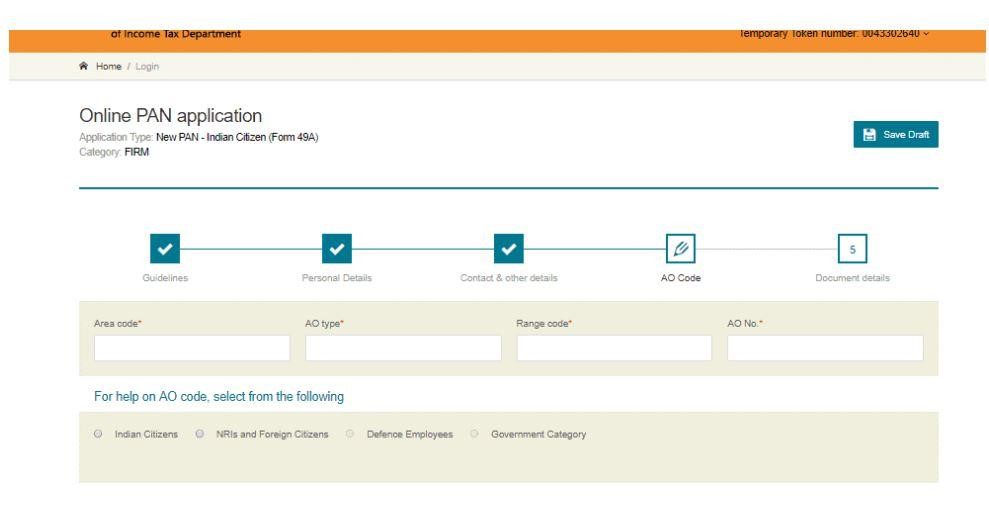

Step five – in the following step, you are obliged to give your area code, assessing office type, range code and considering office number, relying upon your address and its corresponding IT jurisdiction area. Also, you can search your area code by visiting the NSDL website and clicking the AO code search for the PAN link.

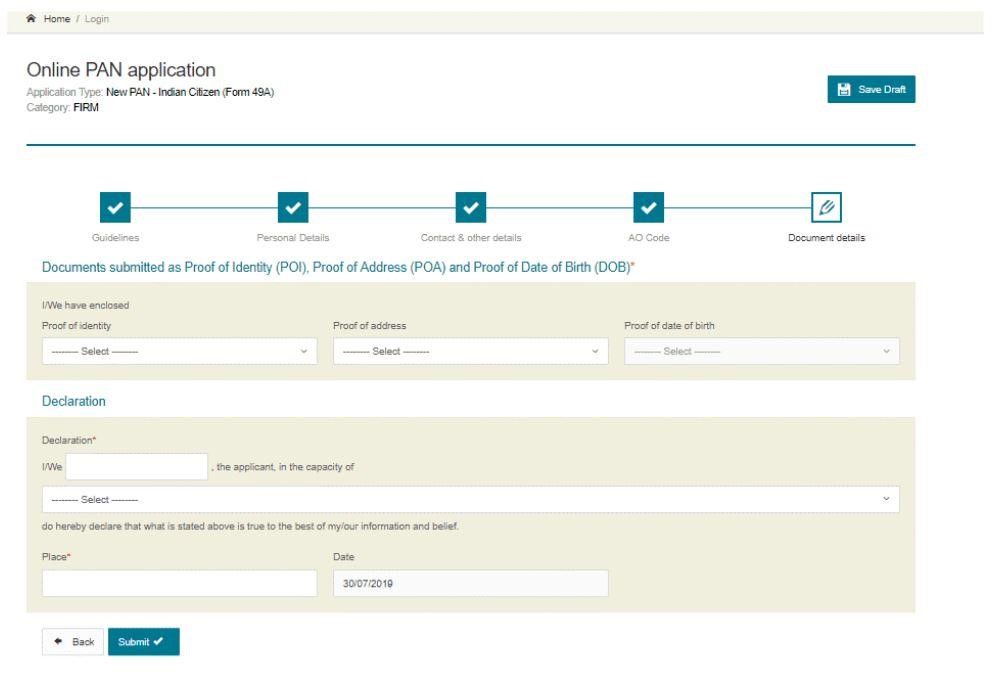

Step six – It is the documentation stage; you will have to upload all the necessary documents required for private company registration.

In the declaration section, you are obliged to specify your relationship with the Company. Only the Company’s director or authorized signatory can apply for a PAN card on behalf of the Company.

Once you fill up the form, the same would be available for your review. Also, after the examination of errors, click the submit button.

Step seven – in this step, you are obliged to pay the stipulated application fee. Likewise, you can make the payment via debit/credit card, net banking, and demand draft (DD).

Step eight – nonetheless, once the payment is made, an acknowledgement receipt bearing a fifteen-digit acknowledgment number will be sent on your Email ID. Also, with this number, you would be able to check your PAN application status online on the NSDL website.

Step nine – you are required to send the signed acknowledgment receipt, along with other hard copies of uploaded documents, to the income tax service unit, NSDL office, Pune. Also, send the DD (demand draft) if you made the payment offline.

Remember that the hard copies should reach the NSDL office within fifteen days from the application’s data. Also, the department would then inspect or examine your application and accompanying documents. That’s why if everything is in order and appropriate, you can expect to receive your PAN card within 15 business days.